The big cut – hairdressers among those hardest hit by Universal Credit change

There are no winners from next month’s large cut to Universal Credit and Working Tax Credit - £20/week (£1,040/year) – but the people losing big are those in work

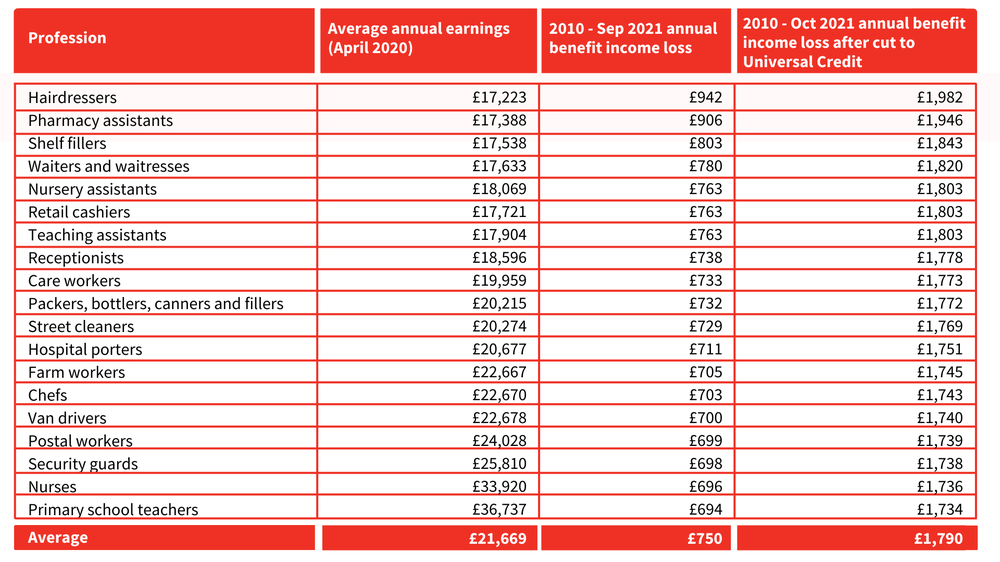

Action for Children’s analysis out today, launching our Star in Every Child campaign, looks at a typical sole-earner family with two children in a selection of common low- to middle-income jobs and shows how much the £20-a-week Universal Credit increase has helped limit the damage of previous cuts to social security for these working families since 2010.

When the £20-a-week cut comes through in October, incomes will fall by £1,040 a year, but as our research reveals, when added to previous benefits squeezes over the last decade, families will lose much more overall.

Our findings show hairdressers will be worst off, losing an average of £1,982 a year after the cut, followed by pharmacy assistants (£1,946 average annual loss) and shelf fillers (£1,843). These are huge amounts for families on relatively low incomes.

Loss in social security for a sole-earner couple with two children living in rented housing from 2010-2021

These figures are based on average annual earnings of a selection of common low- to middle- income jobs for a full-time sole-earner family with two children living in rented housing. Annual earnings come from Figure 6: Annual full-time gross pay by occupation, UK, April 2020, Employee earnings in the UK: 2020, Office for National Statistics, November 2020.

You cannot level up the country by pushing down the living standards of the low paid. It’s a point not lost on government backbench MPs nor on former DWP ministers.

Ministers need to level with the public that this is not a choice between helping those in work or helping those not working. The majority of the households affected will be in work. These are not big earners but people who are proud to work and proud to do everything they can to provide for their children. Don’t forget, 75% of poor children in the UK live in working families.

There’s another inconvenient truth that needs acknowledging, especially with a spending review expected later this year. The taxpayer loses out in the long run when poverty rises - which it does, inevitably, when benefits are cut significantly. The Joseph Rowntree Foundation has estimated that poverty costs the UK £78 billion a year in the extra strain on public services (especially health) and in the knock-on effects, especially on tax revenues when children are stopped from reaching their full potential. Poverty is both a moral disgrace and an economic waste, as David Cameron once said.

This summer marks 50 years since a Conservative government introduced help for low-paid families through the Family Income Supplement – one of Universal Credit’s predecessors.

This government must listen to working families to ensure that this autumn does not see low paid working families lose a vital lifeline.